Travel Tips

Discover how Medicare works when you travel outside the U.S. Understand the limitations, exceptions, and supplemental options available to ensure you have the healthcare coverage you need abroad.

Many Americans on Medicare are curious about their health coverage when traveling or living abroad. This article addresses the limitations and options available for Medicare beneficiaries when they are outside the United States.

Let’s dive into understanding how Medicare works beyond U.S. borders.

Medicare is a federal health insurance program primarily for people aged 65 and older, but it also covers certain younger individuals with disabilities or specific diseases. Understanding the basics of Medicare is essential before exploring its coverage outside the U.S.

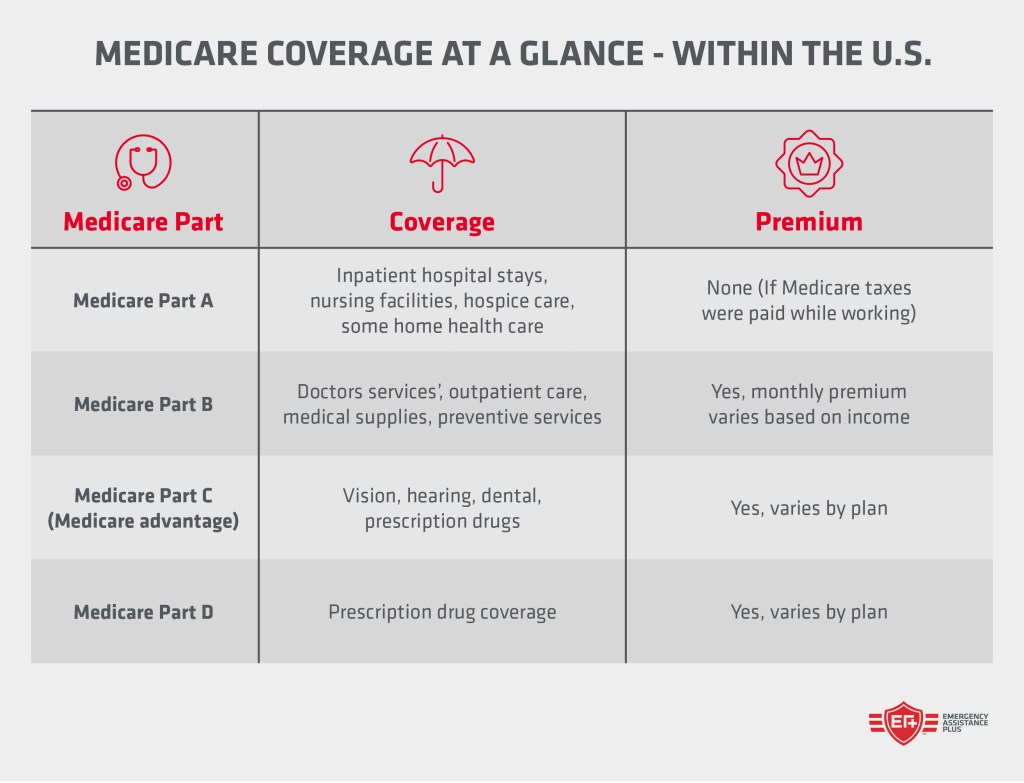

Overview of Medicare Parts A, B, C, and D

Medicare Part A

Also known as “hospital insurance,” it covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Most beneficiaries do not pay a premium for Part A if they or their spouse paid Medicare taxes while working.

Medicare Part B

Known as “medical insurance,” it covers certain doctors’ services, outpatient care, medical supplies, and preventive services. This includes doctor visits, outpatient care, medical equipment, and preventive services like screenings and vaccines.

Part B comes with a monthly premium, which varies based on income.

Medicare Part C (Medicare Advantage)

Offered by private companies approved by Medicare, these plans provide all Part A and Part B benefits. Many Medicare Advantage plans offer additional coverage, such as vision, hearing, dental, and prescription drugs.

This essentially combines Part A and Part B and sometimes Part D, along with extra benefits tailored by private insurers.

Medicare Part D

This part provides prescription drug coverage. It is offered through Medicare-approved private insurers.

Understanding these basics sets the stage for exploring how Medicare functions outside the U.S. in the next section.

Medicare coverage outside the U.S.

Traveling or living abroad raises important questions about healthcare coverage, especially for Medicare beneficiaries. Generally, Medicare has limited coverage outside the U.S., but there are notable exceptions and options for additional coverage.

Standard Limitations on Medicare Coverage Abroad

Medicare Parts A and B do not typically cover healthcare services you receive outside the U.S. and its territories. This includes routine care, emergency services, and elective procedures.

Here are the standard limitations:

3 exceptions to the rule

There are specific situations where Medicare may cover services outside the U.S.:

Understanding these exceptions can help Medicare beneficiaries plan for unexpected medical needs while traveling internationally.

In the next section, we will explore supplemental coverage options to ensure comprehensive healthcare coverage abroad.

4 options to supplement Medicare while traveling abroad

Given the limited coverage of Medicare outside the U.S., exploring supplemental coverage options can provide peace of mind for international travelers and expatriates. Here are some alternatives to ensure you have the necessary coverage abroad.

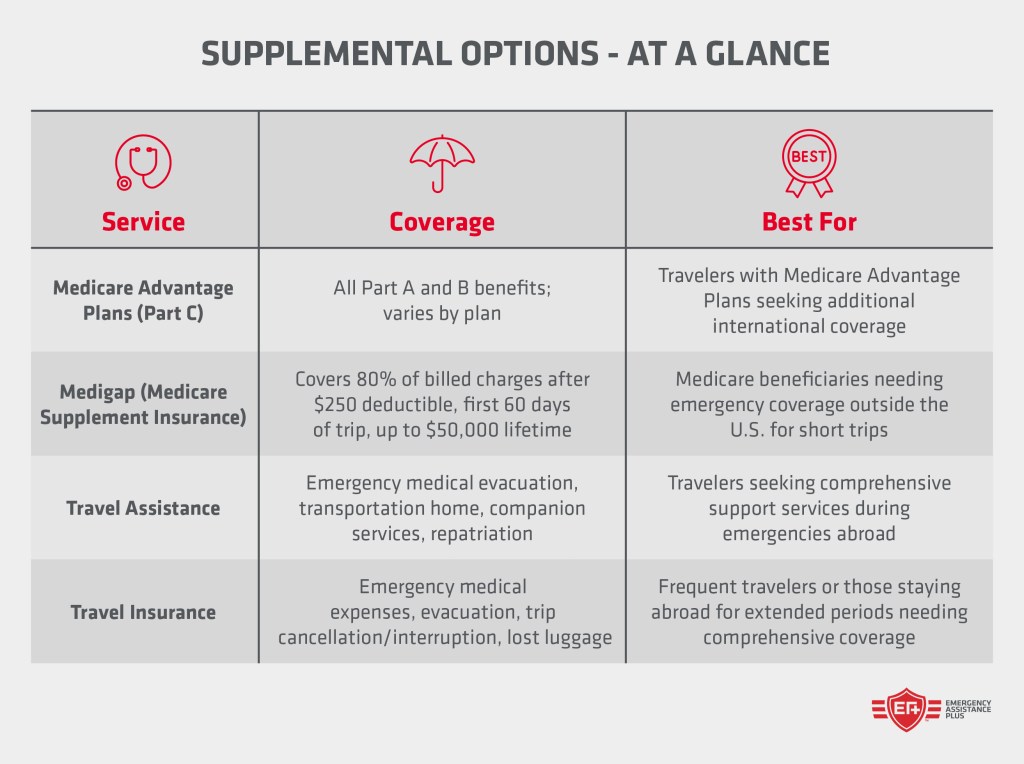

1. Medicare Advantage Plans (Part C) and International Coverage

Medicare Advantage Plans, also known as Part C, are offered by private insurers and provide all Part A and Part B benefits, often with additional benefits like prescription drugs, vision, and dental. Some Medicare Advantage Plans include emergency and urgent care coverage while traveling internationally. However, this varies by plan, so it’s crucial to check the specifics of your plan before traveling.

2. Medigap (Medicare Supplement Insurance)

Medigap policies are designed to fill the gaps in Original Medicare coverage. Some Medigap plans offer coverage for emergency care outside the U.S. These plans typically cover:

It’s important to review the details of different Medigap plans (Plan C, D, F, G, M, and N) to find one that includes foreign travel emergency coverage.

3. Travel assistance

A travel assistance membership, such as Emergency Assistance Plus (EA+), can be a valuable addition to your travel plans whether traveling domestically or internationally. EA+ is an annual service that includes:

With an annual membership, EA+ ensures that you have a team of professionals ready to assist in medical emergencies anywhere in the world, providing peace of mind during your travels.

4. Travel insurance

Travel insurance is another option to consider, especially for those who frequently travel abroad or plan to stay outside the U.S. for extended periods. Travel insurance policies can provide comprehensive coverage, however may be limited to per-trip coverage. Policies can cover:

Many travel insurance plans are customizable, allowing you to choose the level of coverage that best fits your needs.

Comparing supplemental options

When evaluating supplemental coverage options, consider the following:

By exploring these supplemental coverage options, you can ensure you have adequate healthcare coverage when traveling.

Travel assistance plans like EA+ have a high value for a low annual cost. Additionally be aware that some plans have caps on cost and the rest you have to pay out of pocket. EA+ does not have out-of-pocket expenses for emergency evacuation transportation services, there are no health or age limitations, and plans are available at a low annual cost.

In the next section, we will discuss practical steps to prepare for international travel.

How to prepare for international travel

Planning ahead is crucial for Medicare beneficiaries traveling abroad to ensure they have adequate healthcare coverage and know how to access medical services if needed. Here are some practical steps to prepare for international travel.

4 steps to take before traveling

Important documents and contacts to have on hand

Tips for finding and receiving medical care abroad

By taking these steps, Medicare beneficiaries can better navigate healthcare needs while traveling internationally. In the next section, we will explore real-life scenarios and hypothetical examples to illustrate Medicare coverage abroad.

Next steps

Navigating Medicare coverage outside the U.S. can be complex, but understanding the limitations and available options is crucial for any Medicare beneficiary planning to travel abroad. While Medicare typically does not cover routine care or emergency services outside the U.S., there are exceptions and several supplemental coverage options to consider.

Medicare Advantage Plans, Medigap policies, and travel insurance can provide additional coverage, while travel assistance memberships like Emergency Assistance Plus offer comprehensive support and emergency services.

Taking steps to prepare for international travel is essential. Review your coverage, consult your doctor, and gather important documents and contacts before you go.

For a comprehensive safety net, consider joining a travel assistance program like Emergency Assistance Plus. This service ensures you have access to emergency medical transportation such as hospital-to-hospital transport, return home services, medical escorts, medical referrals, repatriation services, and other crucial support services during your travels.

“I Think EA+ May Have Saved Her Life.”

– Manfred A., California

With the right preparation and supplemental coverage, you can enjoy your international adventures with peace of mind.