Medical Evacuation

Medevac refers to the emergency transportation of individuals who are sick or injured to a place where they can receive medical care.

Medevac insurance provides crucial financial protection for individuals requiring emergency medical evacuation from locations where advanced medical care is not readily available. This insurance policy covers the significant costs of critical transportation and immediate medical attention, particularly in time-sensitive and specialized situations.

Understanding this insurance, as well as flexible alternatives like travel assistance and protection, can be a lifesaver—literally. Let’s delve into what medical evacuation is and what traditional medevac insurance does and doesn’t cover.

Medevac, short for medical evacuation, refers to the safe and swift long-distance transport of patients in critical condition to a facility that can provide the necessary medical care. This service is not just about speed; it’s about integrating critical care management with transportation logistics to handle emergencies effectively.

Medevac utilizes various modes of transportation, most commonly helicopters and fixed-wing aircraft equipped as mobile intensive care units. Inside these vehicles, you’ll find trained medical professionals who can provide continuous care en route.

For an idea of how beneficial medevac services can be, imagine Jane, who suffers a heart attack while vacationing in a remote area. She’s stabilized at a small rural hospital, but they lack the specialized cardiology team and equipment needed for further treatment. Thanks to medical evacuation services, Jane is quickly transported to a major medical center where she receives the advanced care that saves her life.

There are three main types of medevac services: air, ground, and water transportation.

Each type of medevac service is designed to provide the highest level of care in different environments, ensuring that patients receive the fastest and most appropriate treatment according to their circumstances.

Medevac insurance, often found within comprehensive travel insurance policies or as a standalone plan, is specifically designed to cover these emergency transportation expenses.

It’s designed to ensure safe transportation to the nearest appropriate medical facility without incurring exorbitant out-of-pocket costs if you face a critical medical situation in a remote area.

While health insurance is designed to cover medical treatment, it often falls short when it comes to medical evacuation costs, particularly from remote locations or across borders. Even with medical coverage, you may be responsible for significant co-pay and deductible costs. This is where specialized products, like medevac travel protection, come into play.

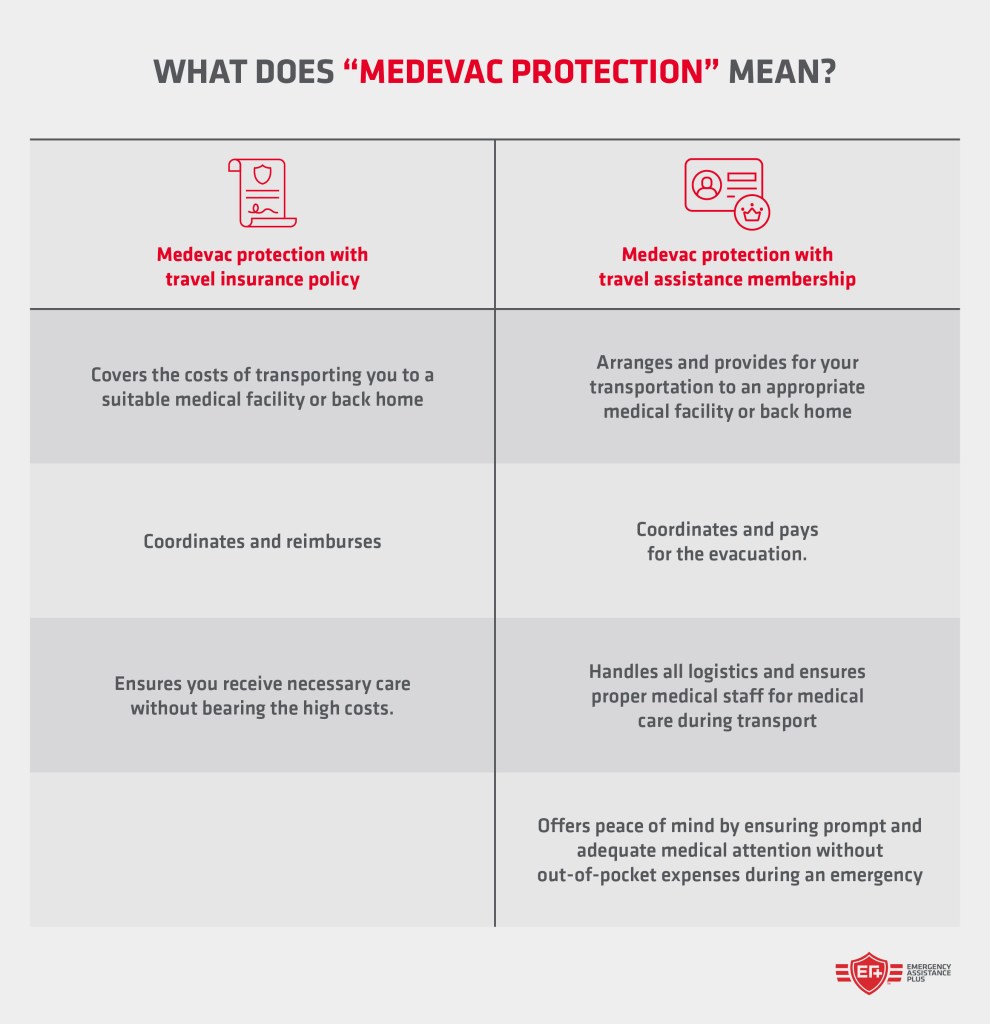

The biggest difference between medevac protection offered through a travel assistance membership (as opposed to an insurance company) is that with travel assistance, your provider will actually coordinate the services for you at no cost, not just reimburse you after the fact.

Medevac services are essential, particularly when medical facilities are not immediately accessible. In remote areas or during critical medical emergencies like heart attacks or severe injuries, medevac can make the difference between life and death.

These services ensure patients receive care during transport, often with advanced life-support capabilities and specialized medical staff on board.

With the coordinated effort between healthcare providers, emergency management professionals, and local authorities, patients receive comprehensive care from the point of injury or illness to the hospital, supplemented by services that address both logistical and personal needs.

Additionally, some medevac providers offer comprehensive membership plans that cover a range of emergency assistance services. These plans enhance peace of mind for travelers, knowing that in the event of a medical crisis, a professional team is ready to manage all aspects of their evacuation and care.

Choosing the right medevac service is crucial and can vary significantly based on individual needs and scenarios. Here are some key factors to consider:

It’s one thing to learn about the role of medevac protection in theory, but it’s quite another to hear real stories from the people who have needed it:

“My wife was at our vacation home in Southern Baja, MX, and I was in the U.S. when I was [told] that my wife was feeling very sick. I flew to southern Baja, and found my wife in terrible pain. I got her right into the local hospital in Loreto. The doctor there planned an emergency surgery the next day (removed the appendix, drained excess fluid and stitched her up). The prescribed drugs did not help and after she got her stitches removed, my wife had not eaten for nearly a week (lived on the hospital intravenous for liquids and antibiotics), the doctor suggested to fly her to the U.S. on an emergency basis.

We contacted the Emergency Assistance Plus team, who, after checking again with doctors and hospitals and completing some paperwork, sent a plane, picked her up, and flew her to the nearest hospital where we live!

The help she got from EA+ here in Mexico, from the hospital to the plane, flight, and drop off at the hospital emergency section was incredible! This flight may have saved my wife’s life in the condition she was in! I can only recommend their service to anyone traveling abroad!”

– Manfred A., California

You can also hear from many other grateful EA+ members who have shared their stories.

Choosing the right Medevac protection is essential for ensuring your financial safety and peace of mind during an emergency requiring medical evacuation. Services like Emergency Assistance Plus® (EA+®) go beyond traditional insurance, providing real-time coordination and support when you need it most.

Medevac insurance costs vary widely based on factors like coverage limits, trip duration, destination, and the insurer. It can range from a few dollars per day to several hundred dollars annually for comprehensive plans.

Sometimes, but not always. Some travel assistance programs include medevac, while others do not. Be sure to verify the policy’s details.

If you are traveling domestically, a policy offering up to $100,000 may be sufficient. For international travel, especially to remote or high-risk destinations, coverage between $250,000 to $500,000 might be more appropriate.

Yes. Most medical evacuation insurance policies or comprehensive travel plans will cover air ambulance services as long as the evacuation is deemed medically necessary. Always verify the specifics of your policy.

Medical Evacuation

Medical Evacuation

Medical Evacuation

Medical Evacuation

Medical Evacuation

Medical Evacuation