Medical Evacuation, Travel Assistance

Repatriation coverage is a service that ensures travelers are safely transported home in the event of a medical emergency or death while abroad. It covers the logistical and financial costs of returning a patient for continued care or arranging the repatriation of remains.

Planning an international trip takes time—you book flights, arrange accommodations, and map out your itinerary. But many travelers overlook planning for the unexpected. What happens if you face a medical emergency or, in the worst case, pass away while abroad?

It’s no fun to think about, but if you want to prepare for everything, this is part of it. Luckily, planning for these scenarios is fairly painless, and that’s where repatriation insurance comes in.

Repatriation insurance ensures that if you suffer a serious illness, injury, or even death while traveling, you or your remains can be safely transported home. Without it, the cost of repatriation can be overwhelming. In this post, we’ll break down what repatriation insurance is, what it covers, who needs it, and why it’s an essential part of responsible travel planning.

Repatriation coverage, sometimes called repatriation insurance, helps cover the cost of returning a traveler home after a medical emergency or death while abroad. There are generally two situations when you might need this type of coverage: medical repatriation and repatriation of remains.

If you’ve been admitted to a hospital due to a serious illness or injury while traveling abroad and local medical facilities cannot provide the necessary treatment, medical repatriation ensures your safe transportation back to your home country for specialized care or recovery. This service is only available to hospitalized patients — outpatient or emergency room visits do not qualify.

Insurance may cover the cost of medical repatriation if the transport is deemed ‘medically necessary’ or ‘medically reasonable.’

The method of travel depends on the severity of your condition:

Various factors influence the cost of medical repatriation, including distance, urgency, the patient’s health status, the number of accompanying persons, and the need for specialized transportation.

The type of insurance used and the specific policy details (deductibles, out-of-network services, etc.) will also significantly impact cost.

If a traveler passes away abroad, repatriation of remains covers the costs of preparing and transporting the deceased’s body home. It’s a sensitive topic, but one that’s important to discuss.

Repatriation insurance can cover the costs associated with embalming, cremation, or international shipping arrangements, which generally range from $3,000 to $20,000.

In cases where professional funeral services or international assistance is needed, especially in remote locations, repatriation insurance can facilitate these complex logistics, providing loved ones peace of mind and support in a difficult time.

Medical evacuation, or medevac, is the emergency transport of a patient to the nearest appropriate medical facility by air ambulance, medically equipped commercial flight, or ground transport. If local hospitals lack the necessary resources for treatment, medical evacuation transfers you to a facility that can provide the proper care.

Situations that require medical evacuation can happen anywhere, whether you’re traveling or not. For example, you may need medevac transport if:

Without coverage, medical evacuation costs can reach tens of thousands of dollars, depending on factors like distance, urgency, and required medical support.

If you’re traveling and and are admitted to a hospital due to one of the scenarios above, medevac protection through travel assistance can help. To learn more about costs and available options, visit Emergency Assistance Plus (EA+).

While medical evacuation and repatriation both ensure patients receive necessary medical care, they serve different purposes. Generally, the main difference is where the medical emergency occurs and where the patient is transported:

Both services prevent travelers and their families from facing overwhelming costs and logistical challenges, but understanding the differences can help you choose the right protection for your needs.

Repatriation coverage provides peace of mind and financial relief during medical emergencies, especially when traveling to areas with limited healthcare. Comparing different plans can help you find the right fit for your travel needs.

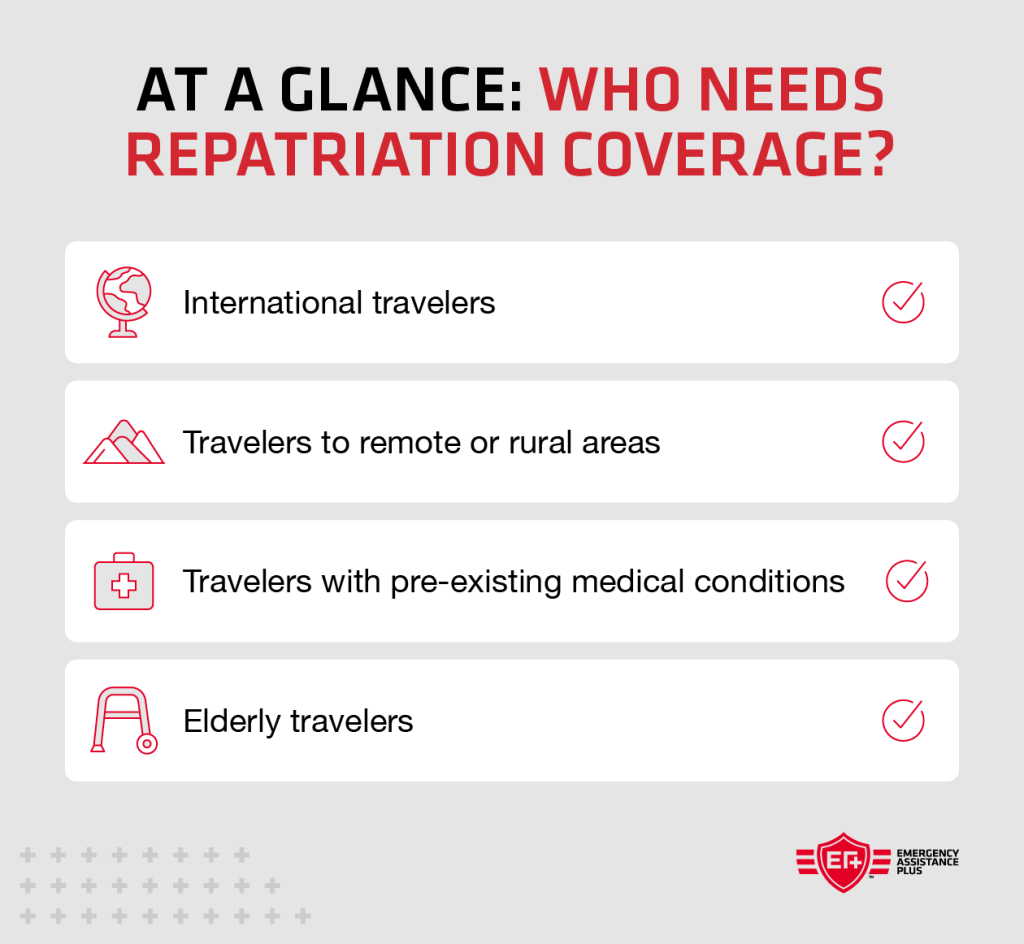

These travelers should strongly consider repatriation coverage:

Before your trip, check the medical facilities available at your destination. If they don’t meet your standards, choosing a repatriation plan that fits your needs can ensure you have a safe way home in case of an emergency.

Benefits of repatriation coverage

Repatriation coverage ensures that travelers receive the necessary medical transport home without the burden of high costs or complicated logistics. Whether facing a serious illness, injury, or an unexpected tragedy, this coverage provides essential support for both travelers and their families.

Key benefits include:

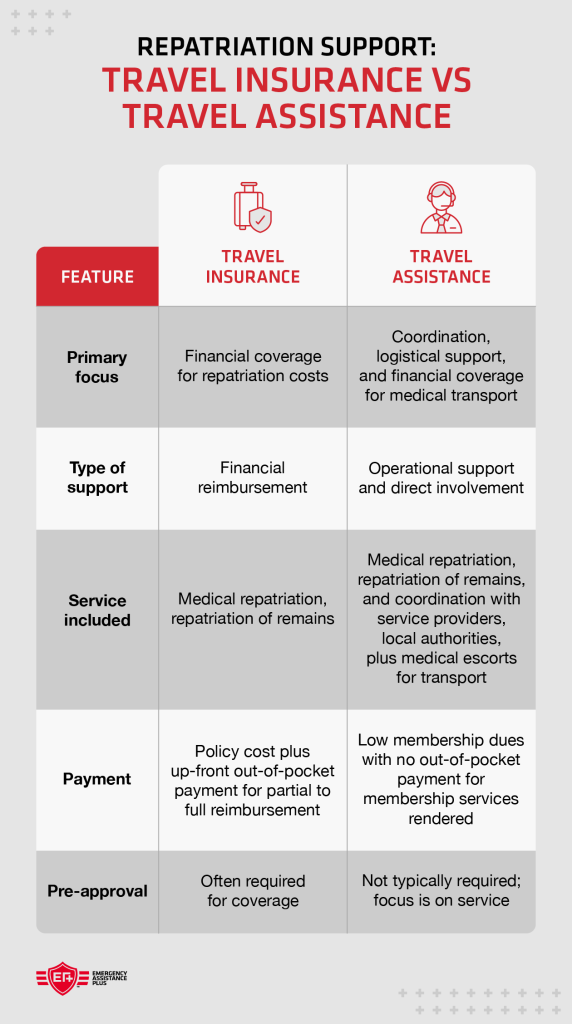

Most travelers don’t purchase standalone repatriation coverage—it’s typically included as part of additional services. There are two main ways to obtain repatriation protection:

Travel insurance’s repatriation coverage covers the necessary and reasonable costs of medical transport, typically based on medical necessity and the urgency of the situation. The decision to repatriate a patient often involves consultation with medical professionals and depends on the ability of local facilities to provide adequate treatment.

Most travel insurance plans cover two key scenarios:

As with all insurance plans, the traveler must arrange services, file a claim, and wait for reimbursement. Payouts depend on policy details, and most insurers impose cost limits. Additionally, “medical necessity” can be a gray area, making claim approvals unpredictable.

A travel assistance membership, like EA+, offers comprehensive repatriation support beyond just financial reimbursement. These services include:

Unlike travel insurance, travel assistance, like EA+, takes care of arrangements up front, offering seamless support during medical emergencies or repatriation situations.

While repatriation insurance and medical evacuation coverage offer essential protection, they often come with exclusions that travelers should be aware of. Understanding these limitations can help you choose the right plan for your needs.

Common exclusions include:

Before purchasing a plan, check the exclusions list carefully to ensure it covers your specific needs—especially if you have pre-existing conditions or plan to engage in adventure activities.

Repatriation coverage isn’t just an insurance formality—it’s a critical safety net for travelers who may need emergency medical care or assistance returning home. Whether it’s medical repatriation or the repatriation of remains, having the right protection ensures that logistical and financial burdens don’t fall on you or your loved ones.

Emergency Assistance Plus (EA+) goes beyond standard coverage by handling every aspect of repatriation, from coordinating medical care to managing complex transportation logistics with sensitivity and expertise.

If your travels take you far from home, let EA+ be your trusted companion. Learn more about how we can safeguard your journey and provide essential assistance when you need it most. Safe travels start here.

In insurance, repatriation refers to the coverage that helps transport a traveler home in case of a medical emergency or death while abroad.

Many travel insurance policies include repatriation, but coverage varies. Some plans only cover medical evacuation, while others include repatriation of remains as well.

A repatriation benefit covers the cost of returning a traveler to their home country due to medical necessity or, in the case of death, repatriation of remains.

Medical evacuation insurance covers transport to the nearest medical facility, while repatriation insurance ensures you are returned home for continued care or after death. Some plans offer both under one policy.

Travel Assistance

Medical Evacuation

Travel Assistance

Travel Assistance

Medical Evacuation

Medical Evacuation