Medical Evacuation

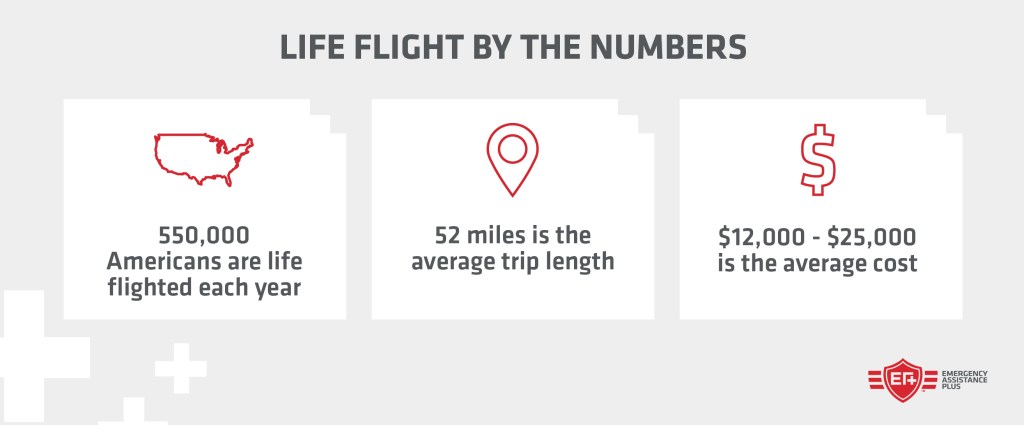

The average life flight costs between $12,000 to $25,000 without insurance.

Average life flight cost without insurance: Ranges from $12,000 to $25,000 or more, depending on your circumstances

Average life flight cost with insurance: Ranges from $0 to $5,000 or more, based on your insurance policy

There are few things in life as scary as being life flighted.

First, if somebody requires the use of a life flight, that means they’re in pretty bad shape. Common situations include:

In any of these scenarios, it’s a Terrifying Situation.

The second frightening thing about a life flight is the cost. Between the aircraft, the pilot, the medical personnel, and a myriad of other factors, a life flight cost can reach between five and six figures depending on the circumstances.

In this post, we’ll break down the costs associated with a life flight, the factors that influence price, the role of medevac insurance, and alternatives.

Let’s get started.

The average cost of life flight within the U.S. ranges between $12,000 and $25,000 per flight. This is based on a 52-mile trip, which is also the average distance. This figure represents an out-of-pocket cost when not covered by insurance or calculated before an insurance company steps in. International air ambulance costs can end up being three to five times that amount.

Depending on the circumstances, however, the cost can be much, much greater.

In December 2020, Sean Deines was diagnosed with acute lymphoblastic leukemia (a fast-growing blood cancer) and took a life flight from Colorado to North Carolina, which also included ground transportation between hospitals and airports. His total bill was $489,000.

So why did this emergency service cost so much more than the average? Because of the various factors involved in determining the total cost.

Costs in health care are notoriously complex in their calculation. There are many socio-economic factors that are beyond the scope of this article, but we will dive into some of the more tangible circumstances that affect the cost of emergency air transport.

Costs in health care are notoriously complex in their calculation. There are many socio-economic factors that are beyond the scope of this article, but we will dive into some of the more tangible circumstances that affect the cost of emergency air medical transport.

Distance traveled

As you can imagine, much of the cost is calculated from the distance traveled—the longer the trip, the greater the cost. These costs flow logically and naturally—more miles flown means more fuel used, more hours for the crew, etc.

In the example above, Sean Deines’ $489,000 life flight and ground transportation covered 1,468 miles from Colorado to his home state of North Carolina. Considering the average trip is only 52 miles, you can start to see how the distance traveled significantly affects the cost.

Fixed-wing aircraft vs helicopter

Many people think a life flight means that the patient was flown in a helicopter, but that’s not necessarily true. Fixed-wing aircrafts are frequently used as air ambulances when the situation allows. And due to reduced costs, fixed-wing flights are often preferred over helicopter life flights.

There are a few situations in which an airplane is a much better option than a helicopter:

The equipment and staff required

To state the obvious, the bigger the plane, the bigger the bill. Other factors that can potentially increase the cost of air medical transport include if the patient requires specialized equipment or specialty medical personnel to administer to their needs. For context, many of these aircrafts are basically flying emergency rooms; equipped with sophisticated medical technology to ensure the patient remains stable during transport.

International transportation

When crossing country borders or repatriating, there can be additional costs involved. Many airports charge landing and handling fees when patients are transferred using chartered planes, which adds to the cost of the flight.

There is generally paperwork required to obtain approval to fly from one country to another that is set by local regulatory agencies. Depending on the circumstance, there is potentially a cost to this process as well.

Lastly, if a patient is being transferred from a nation that is deemed a conflict zone or a high-risk area, obtaining authorization for emergency medical repatriation can be costly, which increases the total repatriation costs.

Sometimes, but not always. All health insurance plans are different, and your best bet to understand if your individual life flight situation will be covered by insurance is to speak directly with your provider.

That said, there are some things you should know.

The most significant factor in determining if life flight services will be covered by an insurance plan offered through their employer, a self-insurance plan, Medicare, or Medicaid is if the service is deemed “medically necessary.” This term, however, is up to interpretation by the insurance provider.

For example, if somebody has a serious medical emergency, is admitted to a medical facility where they can be sufficiently treated, but chooses to engage life flight services back to their preferred hospital, the flight could potentially be deemed unnecessary because they could have been treated on site.

There are roughly 550,000 life flights every year in the United States, according to the Association of Air Medical Services. The majority of these air medical trips are due to accidents and emergencies, as opposed to pre-planned transportation.

If your health plan does cover life flight services, your out-of-pocket costs could be as low as your copay and/or out-of-pocket maximums of your insurance coverage; this assumes the life flight is in-network and deemed “medically necessary,” of course.

However, between 50% and 69% of life flights are out-of-network, and thus could lead to out-of-pocket costs totalling thousands of dollars even with insurance.

The No Surprises Act, in effect since January 2022, was designed to help cut down on these types of massive, unexpected medical bills due to engaging out-of-network services during emergencies. The bill places particular emphasis on out-of-network life flights, but ground transportation (often included in emergency medical transport) is not included, so consumers may still receive an unexpected bill as a result.

If you have any doubts about what your insurance company may be able to provide in terms of coverage for life flights, follow these tips for managing the high cost of life flight.

“My wife became seriously ill during a stay at our condo in Tennessee. I called 911 and she was transported to a nearby medical center and admitted. After 12 days of treatment, it was determined my wife needed specialized care not available at the current facility. I contacted EA+ and they worked with my wife’s doctors to finalize arrangements for transfer by air ambulance to a hospital in Knoxville.

I would like to commend the team at EA+ and the staff that made the air ambulance trip with my wife. They were all very professional. The entire staff at the hospital in Knoxville could not believe the way EA+ did everything that was promised. Your staff could not have been any better to me and my wife.

I have told many people about this amazing program. I am proud to endorse EA+.”

David H., Tennessee

Life flight costs can seem daunting, but there are ways to safeguard your loved ones (and your wallet). Apart from insurance companies, many travel assistance providers offer medical evacuation and transport as part of their core services. Emergency Assistance Plus offers emergency medical evacuation via ground or life flight if deemed medically necessary to get you to a more appropriate hospital if your current facility can’t properly treat your medical condition.

Learn how EA+ can protect you from unexpected life flight expenses and explore our comprehensive membership options today.

The average cost of life flight in the U.S. ranges between $12,000 and $25,000 per flight. However, longer distances or specialized medical needs can easily push that figure up to $150,000.

Sometimes, but not always. Coverage depends on your policy and medical necessity. Even with coverage, you may still face significant out-of-pocket expenses due to deductibles, co-pays, or out-of-network charges.

Medicare Part B may cover medically necessary air transport, but with limitations and potential out-of-pocket costs. Pre-authorization is often required, and coverage is typically restricted to situations where ground transport is not feasible.

Medical professionals determine the need based on critical injury or illness requiring immediate, rapid transport. Factors such as the severity of the injury, the distance to a suitable medical facility, and the patient’s condition are all taken into account.

Medical Evacuation

Medical Evacuation

Medical Evacuation

Medical Evacuation

Medical Evacuation

Medical Evacuation