Travel Insurance

Travelers purchase travel insurance to cover unexpected events like trip cancellations, medical emergencies, or lost luggage. It helps them recover costs from delays, injuries, or travel disruptions.

Travel insurance protects travelers from financial losses due to unexpected events such as medical emergencies, trip cancellations, lost luggage, or travel delays.

According to the U.S. Travel Insurance Association, American travelers spent $5.56 billion on travel insurance in 2024, a 46% increase from 2019. This rise reflects the growing importance of travel protection amid evolving travel safety trends in response to global disruptions.

Understanding travel insurance statistics empowers travelers to make smarter protection choices, helping them prioritize policies with the coverages most likely to be used, ensure they’re not underinsured, and select options that offer the best value for their specific travel needs.

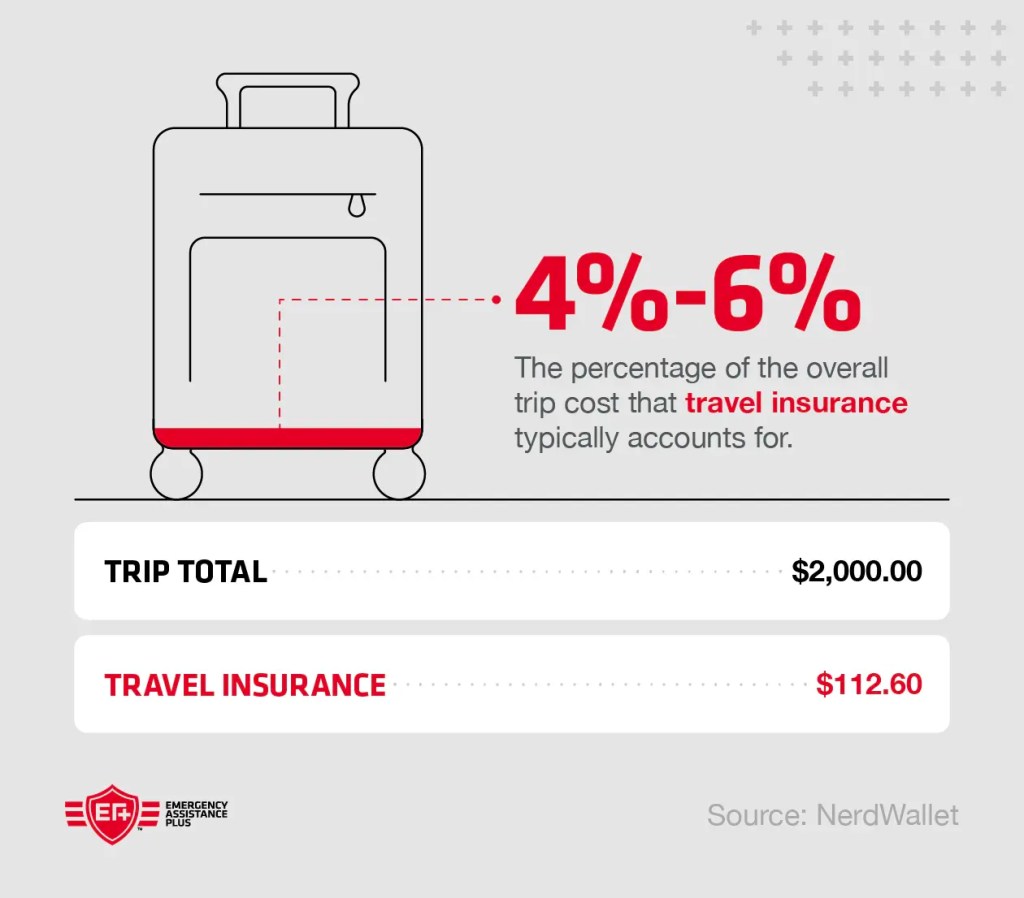

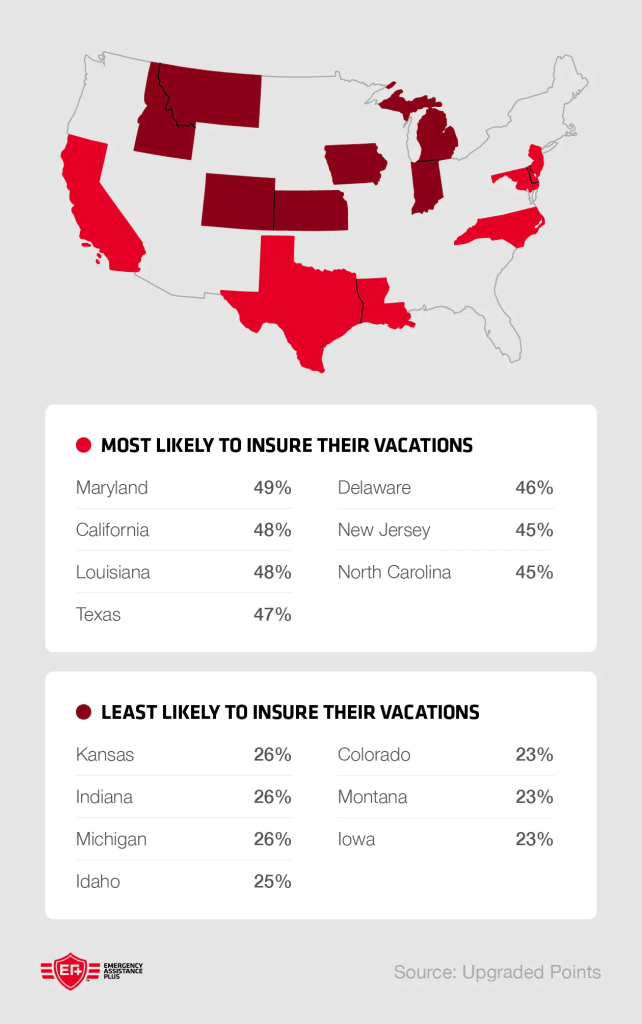

Travel insurance plays an important role in protecting trips and expenses. Here are some key stats to give you a clearer idea of its usage and average costs.

While travel insurance and health insurance both offer important protection, they cover different types of risks. Here are some key facts and stats to help you understand travel insurance better.

Key trends are shaping the travel insurance industry in 2025. These insights can help travelers handle common travel emergencies like a pro.

As traveler demographics evolve in 2025, the demand for specialized coverage like travel insurance for pre-existing conditions is growing. Staying informed about these changes helps you get protection tailored to your unique needs.

In 2025, travel insurance claims showed clear shifts reflecting how travelers’ needs are changing. The most common travel insurance claims are for unexpected trip cancellations and interruptions, while emergency medical expenses remain a top concern, especially for longer or riskier trips.

Claims related to long distance medical transport may be becoming more common as travelers increasingly seek protection for serious medical situations abroad. These trends suggest the growing complexity of travel risks and highlight why having the right coverage is more important than ever.

Understanding travel insurance statistics empowers you to make informed decisions about whether travel insurance is worth it for your trip or if alternative options might be a better fit. By recognizing key risks and traveler behaviors, you can confidently choose protection that meets your needs.

Unlike traditional travel insurance, Emergency Assistance Plus® (EA+®) is an emergency travel assistance program that offers yearly membership plans, making it a cost-effective and convenient option for frequent travelers. With plans designed to help in case of many emergencies, EA+ helps you take control of your travel protection and journey with confidence.

Enroll nowThe best yearly travel insurance option offers broad coverage for multiple trips, including strong medical, trip cancellation, and baggage protection. Top providers in 2025 include:

If you’re looking for the best travel insurance for seniors, be sure to compare plans that offer enhanced medical coverage and emergency support.

For added peace of mind, you might also consider alternative travel protection options like EA+. Unlike traditional travel insurance, EA+ is a yearly membership plan that applies to all your trips, so you don’t need to purchase added protection for each journey. It provides services such as emergency medical transportation, assistance after hospitalization, and 24/7 global support.

With EA+, you don’t have to pay upfront and wait for reimbursement. Because it provides real-time assistance, services included in your membership are arranged and paid for directly at the time of need. This makes EA+ a convenient and cost-effective option for frequent travelers who want reliable support across multiple trips.

When comparing annual travel insurance vs. single trip, consider how often you travel each year. Choose single-trip insurance for occasional travel with coverage tailored to one journey, or go with annual insurance if you travel frequently and want year-round protection.

Annual plans are often more cost-effective and convenient for frequent travelers, saving time and money over multiple trips.

In 2024, 86.97 million people were protected by 54.87 million travel insurance plans from USTIA members, which include major U.S. providers such as Allianz, Travel Guard, and Generali.

While $100,000 can be enough for basic medical protection, many travelers opt for higher limits to ensure comprehensive coverage in the event of serious medical emergencies, costly treatments abroad, or extended hospital stays.

Common coverage ranges for travel insurance include:

Travel insurance isn’t the only way to protect your trip. Other strategies and services include:

Travel insurance is quite profitable for most insurers and agencies, often generating profit margins between 20% and 50%. This could be due to many policies going unused, or claims being lower than expected

Travel Insurance

Travel Insurance

Travel Insurance

Travel Insurance