Travel Insurance

Should you supplement your health insurance or Medicare plan with travel insurance while traveling? We’ll discuss the details in this post.

Nobody likes to think about it, but accidents and medical emergencies can happen while traveling.

While it may be impossible to predict when or where health emergencies arise, you can control how you’re protected, both personally and financially. Your regular health insurance, specially bought travel insurance, or travel assistance membership may be able help, but it’s not always clear what types of medical services are covered while you travel.

A lot of people end up with the same question:

“Do I need travel insurance for a trip, or will my normal health insurance/Medicare cover me?”

In this post, we aim to clear up any confusion around how travel insurance works vs. your own health insurance. We’ll also provide some tips on how you can protect yourself and your loved ones from personal and financial risk in the event of a medical emergency.

Let’s get started.

Travel insurance focuses on protecting you against unexpected events and disruptions during your trips. Health insurance provides ongoing coverage for medical expenses, whether you’re traveling or not. To understand the full details, you’ll need to read the terms of both types of insurance policies to ensure you have the appropriate coverage for your needs.

However, we can break down the general differences for you here.

Travel insurance is primarily focused on providing coverage for unexpected events that can occur while you’re traveling. This can include trip cancellations, lost baggage, flight delays, emergency medical expenses, and more. Travel insurance is designed to protect you financially from disruptions and risks associated with travel by reimbursing you for any covered events you had to endure.

Health insurance, on the other hand, is designed to cover medical expenses related to illnesses, injuries, and medical treatments. It’s intended to provide financial support for healthcare services, doctor visits, hospital stays, surgeries, and prescription medications.

Travel insurance is often purchased for specific trips and has a defined start and end date. It provides coverage only during the period of your travel. Note that you can also buy annual or multi-trip travel insurance.

Related reading: Everything You Need to Know About Annual Travel Insurance

Conversely, health insurance provides coverage on an ongoing basis, typically for a set period (such as a year) and can be renewed. It covers medical expenses that occur both within and outside of travel, although most U.S. health insurance plans do not cover medical expenses incurred while abroad.

Travel insurance premiums are often calculated based on the cost of your trip, the duration of travel, the coverage options you choose, and factors related to the destination’s risk profile. Additionally, most insurance providers will factor in your age and any existing medical conditions.

Note: Travel insurance is also subject to co-pays, deductibles, and dollar caps for certain benefits.

As a general rule of thumb, you can expect to pay anywhere from 6-11% of the trip’s value.

Health insurance premiums are determined by various factors, including your age, health history, coverage level, and the type of plan you select (e.g., HMO, PPO, high-deductible plan).

Travel insurance can sometimes provide secondary coverage, meaning it pays out after existing insurance policies (such as health insurance) have been used. It can cover costs that your primary insurance may not fully cover, especially when traveling internationally.

Health insurance provides primary coverage for medical expenses incurred within its coverage network. It is intended to cover your medical costs first, regardless of whether you’re traveling, with the exception (again) being that most U.S. health plans do not cover medical expenses incurred while abroad.

This is a personal preference, but as you can see from the previous section, travel insurance and health insurance generally cover different things. The decision comes down to several factors, including, the extent of coverage provided by your existing health insurance, the nature of your trip, and your personal risk tolerance.

Here are some practical considerations and tips to help you decide.

The very first thing you need to do is check your existing health insurance policy to see if it provides coverage for medical expenses incurred while traveling abroad. Some health insurance plans offer limited coverage for emergency medical care while you’re out of your home country, but this coverage might not be comprehensive.

Note: Medicare typically doesn’t cover medical treatment while abroad unless you buy additional supplements (more on that below).

Travel insurance often includes coverage for medical evacuation and repatriation, which can be crucial in case you need to be transported to a different medical facility or returned home after a medical emergency. These services may or may not be covered by standard health insurance plans.

Here’s a quick breakdown of how medical evacuation is handled by travel assistance, travel insurance, and health insurance:

Travel insurance can protect you financially if you need to cancel or interrupt your trip due to unforeseen events like illness, injury, or family emergencies. Health insurance usually doesn’t cover non-refundable trip expenses.

If you’re planning to engage in adventurous activities or sports during your trip, travel insurance might provide coverage for potential injuries related to these activities. There are even specific plans that are created for particular activities (i.e. scuba diving) you have planned. Your regular health insurance might exclude coverage for certain high-risk activities.

Your health insurance may have deductibles, co-pays, and limitations that could result in out-of-pocket expenses while traveling. Travel insurance may help cover medical-related costs, but of course you’d need to check the policy to ensure those were covered.

If you’re traveling to a country with limited or lower-quality medical facilities, travel insurance may be able to provide access to better medical care and transportation to a suitable facility if needed. Note that your health insurance will also evacuate you to a new facility if the location you’re at is unable to treat you.

In most situations, health care you receive while traveling outside the U.S. is not covered, according to Medicare.gov. There are some exceptions, however.

For example, if you suffer a medical emergency while traveling through Canada to get to an Alaskan destination, and the nearest medical facility is in Canada, Medicare may cover your treatment.

There is a Medigap policy you can buy to cover emergency care received while traveling internationally. Some plans cover emergency health care and have a lifetime limit of $50,000.

Here are two other pertinent details via Medicare.gov.

“Plans may:

Please note that information can change, and it’s recommended to contact Medicare, your Medigap, or Medicare Advantage plan provider to verify the most up-to-date details regarding Medicare coverage for international travel before making any decisions.

There is one incredibly important thing to note about all types of insurance; whether health or travel:

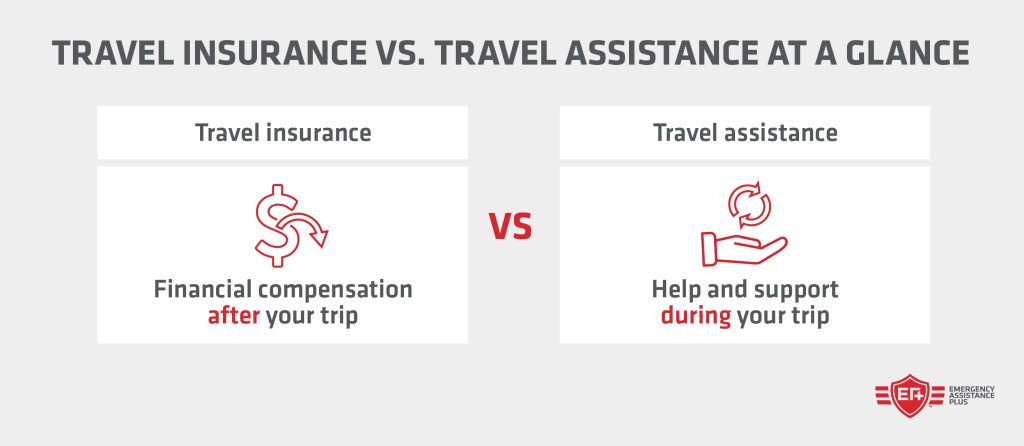

Travel insurance is designed to reimburse you after the situation has resolved. It doesn’t provide much proactive help in your time of need.

If you’re traveling and have a medical emergency, a travel assistance membership can get you the help you need, and it all starts with a single phone call.

Unlike health or travel insurance companies, many travel assistance providers have response centers to take your call when you need help.

For example, Emergency Assistance (EA+) plus is available 24/7/365 to take your call and arrange travel assistance services no matter where you are in the world*. Common types of services we arrange include:

*Note: There are certain circumstances in which a particular country may not be eligible for services from EA+, for example if the country is an active war zone.

Just to name a few—check out more details on our plan information page.

Travel assistance is a great way to fill in any gaps that your health or travel insurance policy may have. If you’d like to learn more about travel assistance, please see these related resources:

Or better yet, give us a call! Speak with an expert about the benefits of a travel assistance membership: 1-866-863-4460.

Travel Insurance

Travel Insurance

Travel Insurance

Travel Insurance