Let’s unpack the ins and outs of securing your trip with baggage insurance.

Published on January 18th, 2024 in Travel Insurance, Travel Tips

Secure Your Trip: A Complete Guide to Baggage Insurance

You’ve saved for that dream vacation, packed your bags, and are ready to embark on your journey.

But have you considered all the potential mishaps that could happen to your luggage? From being lost in transit, damaged, or delayed—the risks are virtually endless. Enter baggage insurance; an often overlooked yet crucial aspect of travel planning.

Ready to dive into the world of baggage insurance? Let’s unpack the ins and outs of securing your trip.

Key takeaways

How does baggage insurance work?

Baggage insurance is a component of travel insurance, offering protection for your luggage and its contents from the uncertainties of travel. Imagine a scenario where you land at your dream destination, but your luggage decides to take a detour. Not only could you lose your favorite outfits, but there might also be valuable items at stake. This is where baggage insurance benefits come into play, providing baggage loss coverage benefits that can go up to $2,500 or $3,000.

The coverage is not just limited to lost luggage.

What if your bags were delayed, and you’re left without your essentials in another country? Baggage delay insurance can step in to reimburse you for essential personal items purchased during the wait for your delayed bags. It applies to both checked and carry-on luggage, with daily allowances generally around $200 per person. To successfully claim your insurance, you need to understand your policy’s exclusions, estimate your luggage’s value, and maintain comprehensive documentation, particularly for items of high value.

What does baggage insurance cover?

Baggage insurance covers the loss, theft, or damage to your luggage and the personal items packed inside, as well as any expenses incurred due to baggage delay. This means if you’re carrying any expensive or valuable items, baggage insurance can be your safety net. However, every safety net has its holes, and in this case, it’s the individual item limits which determine the maximum coverage for a specific item.

What does baggage insurance NOT cover?

While baggage insurance covers a broad spectrum of issues, it’s not all-encompassing. Some typical exclusions in baggage insurance policies include unattended luggage and losses not reported to authorities. This highlights the importance of keeping a close eye on your belongings and promptly reporting any losses.

The reimbursement for a baggage claim is typically determined by the lower of the cost to repair or replace the item or the actual cash value of the item.

High-value items and additional coverage

Many baggage loss insurance policies do not typically cover high-value items such as electronics, jewelry, and designer goods. If you’re planning to carry along your latest gadgets or that precious family heirloom, it might be worth considering additional coverage. This offers increased protection for such valuable items that could incur damage, loss, or theft while traveling.

But the coverage doesn’t come without its limits; for example, the TripProtector Preferred plan from HTH Worldwide may cap the coverage at $500 total and $250 to $500 per specific item.

When it comes to extremely high-value items like engagement rings, it’s advisable to exercise caution, especially if they lack additional insurance coverage. The financial repercussions in the event of damage, loss, or theft of such items could be significant.

How much does baggage insurance cost?

The price for peace of mind varies significantly, with baggage insurance costs for a one-week international vacation fluctuating between $37 to $100, or possibly even more. A $63 baggage insurance plan, for instance, may provide coverage of up to $750 for lost or stolen luggage. On the higher end of the spectrum, a baggage insurance plan in the range of $100 could provide coverage for up to $2,500 in the event of lost or stolen luggage.

The cost of baggage insurance can fluctuate based on coverage limits, and it is frequently bundled as a component of comprehensive travel insurance policies, offering a more comprehensive protection for travelers.

Evaluating the benefits of baggage insurance

Baggage insurance offers numerous benefits, making it a wise choice, especially when traveling with high-value personal items. The benefits of baggage insurance include:

These benefits ultimately provide convenience and peace of mind for travelers.

The convenience factor

Imagine landing in Paris, ready for a romantic weekend getaway, only to find out that your luggage has decided to party elsewhere. With baggage insurance, this inconvenience becomes more manageable.

This ensures that travelers do not suffer financial loss during their travels.

Financial reassurance in unforeseen circumstances

Baggage insurance doesn’t only provide convenience; it also offers financial reassurance during unpredictable circumstances. The standard reimbursement rates for lost or damaged luggage under baggage insurance varies, but an example might be a maximum liability amount around $3,800 per passenger for international flights and around $2,350 for domestic flights.

How to choose a baggage insurance policy

Selecting the optimal baggage insurance policy can be likened to choosing the ideal travel companion. It involves comparing different travel insurance plans, understanding the policy terms and conditions, and weighing the coverage against the cost.

Comparing travel insurance plans

In comparing travel insurance plans, consider the following factors:

The coverage limits and deductibles among travel insurance plans, which can vary significantly.

It’s also important to check whether baggage delay coverage is included in the travel insurance plan. You wouldn’t want to be left stranded without a change of clothes and toiletries if your baggage decides to take an unscheduled detour. Companies like Allianz Global Assistance are known for their extensive baggage insurance coverage, but the best choice ultimately depends on your individual requirements and the specifics of the plan.

Tips for a seamless baggage claim process

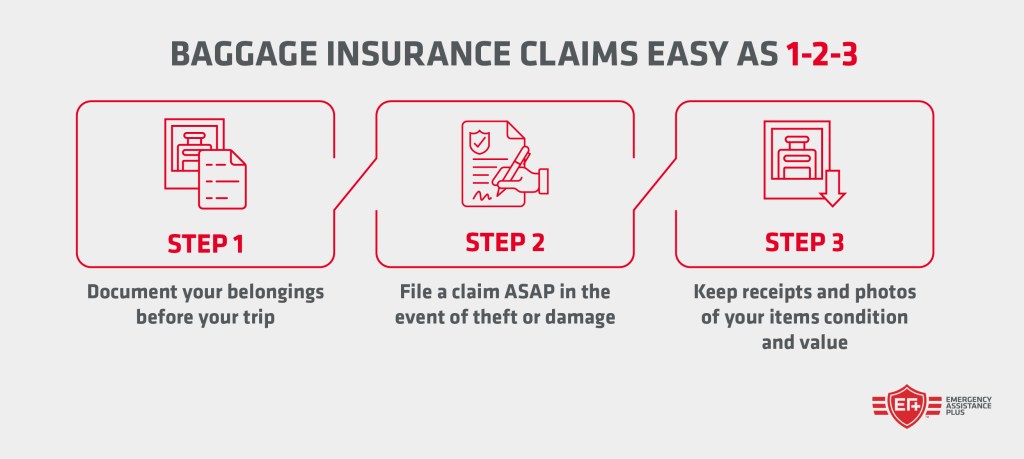

To ensure a seamless baggage claim process, it’s important to document your belongings and take immediate action in case of loss or theft.

Document your belongings

Maintaining a record of your belongings equates to creating a safety net for your luggage. Here are some important items to include in your record:

These items can serve as crucial evidence during the claim process.

For high-value items, it’s advisable to take pictures or videos, keep copies of receipts, and provide original receipts if required for reimbursement. This not only validates your ownership but also bolsters your claim, streamlining the claims process.

Immediate actions in case of loss or theft

Your immediate actions upon realizing your luggage is missing can significantly impact your claim. It’s important to promptly report any lost or stolen luggage to the relevant authorities or airlines and initiate the process of filing a claim with your insurance provider.

From locating the airline’s baggage desk and informing the agent about the missing bag, to providing necessary details and keeping a copy of the report, these initial steps can set the course for a seamless claim process. Remember, necessary documentation may encompass:

Standalone baggage insurance vs. comprehensive travel insurance

Deciding between standalone baggage insurance and a comprehensive travel insurance plan is akin to choosing between a single-item menu and a buffet. Standalone baggage insurance offers limited coverage specifically for luggage, whereas comprehensive travel insurance provides broader protection encompassing various aspects of travel beyond just baggage.

When deciding between the two, consider the following factors:

Remember, standalone baggage insurance is constrained in scope, generally providing less coverage compared to a comprehensive travel insurance policy. Additionally, luggage insurance should not be confused with flight insurance, although they do have some overlap in terms of protection offered.

Baggage insurance for special cases

As an athlete traveling for a competition or an outdoor enthusiast transporting your own sports equipment, you might have to evaluate specific baggage insurance plans or seek extra coverage. A travel insurance company may offer specific plans for such special cases. For example, Allianz Partners’ OneTrip Prime plan and Bernhard Reise luggage insurance are tailored for individuals with unique circumstances.

Traveling with sports equipment requires a different set of rules, with the payout determined by the lowest of the actual cash value of the equipment, the cost of repair or replacement, or the specified limit of the policy. For high-value items, original receipts are necessary for full reimbursement claims. Even sports competitions are covered, with limits varying across policies.

Where to buy baggage insurance

If you’re ready to buy baggage insurance, there are essentially two options:

Let’s cover both.

Baggage insurance only

Here are two reputable options for baggage insurance:

Comprehensive travel insurance

If you’re looking for baggage insurance as part of a more comprehensive travel insurance policy (recommended!) you have tons great options to choose from; here are just a few:

The bottom line on baggage insurance

Ultimately, baggage insurance is an essential consideration for travelers, providing financial security and peace of mind amidst luggage-related issues. It has demonstrated its value in cases of lost, damaged, or delayed baggage, providing coverage and reimbursement for personal belongings.

Whether it’s standalone baggage insurance or incorporated in a comprehensive travel insurance plan, understanding the coverage, cost, and claims process is key to making an informed decision.

Our mission is to empower you on your adventures. Sign up today for our free monthly newsletter.

Subscribe TodayRelated resources

Destinations

Your comprehensive guide to exploring Europe's rivers through immersive and scenic river cruises.

Continue Reading

Destinations

Discover ten thrilling adventures for couples, from skiing in Aspen to surfing in Hawaii.

Continue Reading